Benefiting from short term corrections

TLDR - Short term corrections, can FIRE investors benefit from that?

As a Financial Independence Retire Early (FIRE) investor, your investments need to be long term focused. They better be, else your FIRE dreams will go up in flames and you will end up having to go back to work and not enjoy FIRE at all.

I am assuming most of you have gone through multiple booms and bust cycles. Starting from

- the Asian financial crisis in 97/98,

- Dot com boom in 1999/2000,

- the dot com and post Sep 11 bust in 2001

- pre-subprime boom

- post subprime crash

- the relatively long stagflation and bull run till now.

These cycles are part of the market and if you are not ready to ride this roller coaster then you are not ready to invest in markets. Stick with bonds or deposits. As you can imagine the movement of NIFTY in the example above is never a straight line even outside these big boom/bust cycles. It is definitely going up and down in between sometimes into correction territory before going back up.

Let us look at the period post subprime crisis say from Jan 2010 to now. A good 8 years of data for us to review

Yes, we have been in a fairly long bull market, but there have been some good number of corrections during this period as well. Correction is probably a strong word, let us call them pullbacks just so that the purists are not offended.

As a FIRE investor how can you take advantage of these pullbacks as most of the time you are long on your investments.

There are a few options

1) Supplement your SIP

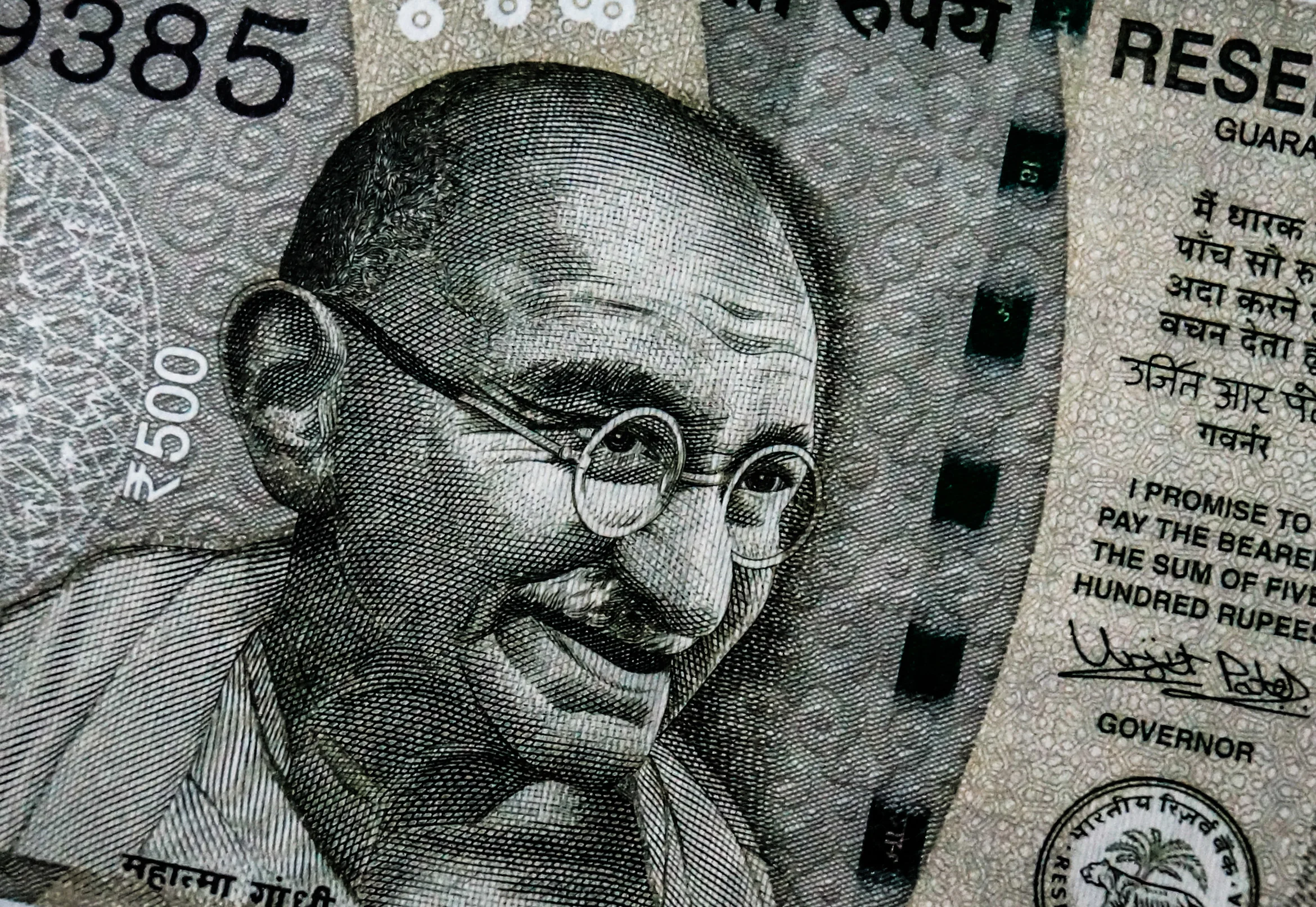

This is probably the simplest option of the lot. If you are a mutual fund or ETF investor and you see these corrections / pullbacks, use them as additional buying opportunities. Assuming you are investing 50K rupees via your SIP every month and you see some strong pull backs ~10% then deploy additional cash if possible to buy more of the same funds/ ETFs during the pull back. Invest your increment / bonus / windfall / other savings into buying more during these corrections.

2) Use VIP or TIP

Some fund houses and demat accounts provide a variation of SIP which automatically allocates more during a correction / pullback.

VIP - Value-Averaging Investment Plan, allows you to set a range (Min - Max) of amount that can be debited in your SIP to allow for market variations and allow you to be more efficient with regards to investment allocation

TIP - Targetted Investment Plan, allows you to set a target amount or goal that you want to accomplish and allows to vary the investments based on market conditions. Very similar to VIP but with a goal in mind

3) Put options

This is a riskier option (No pun intended). You could buy puts on the ETFs or indexes that you are currently holding if you are fairly confident that markets are going to pullback / correct. The size of the lot, expiry and period is all dependent on your risk tolerance and market read. This could provide some downside protection on your long positions and help soften the blow of these corrections.

Warning: If you bet wrong in a derivative product like option (or even worse shorting Futures) you could end up losing your entire premium. So this is definitely not recommended for the faint hearted.

Do you have any other tips and tricks that you deploy against market corrections? Leave your comments below.